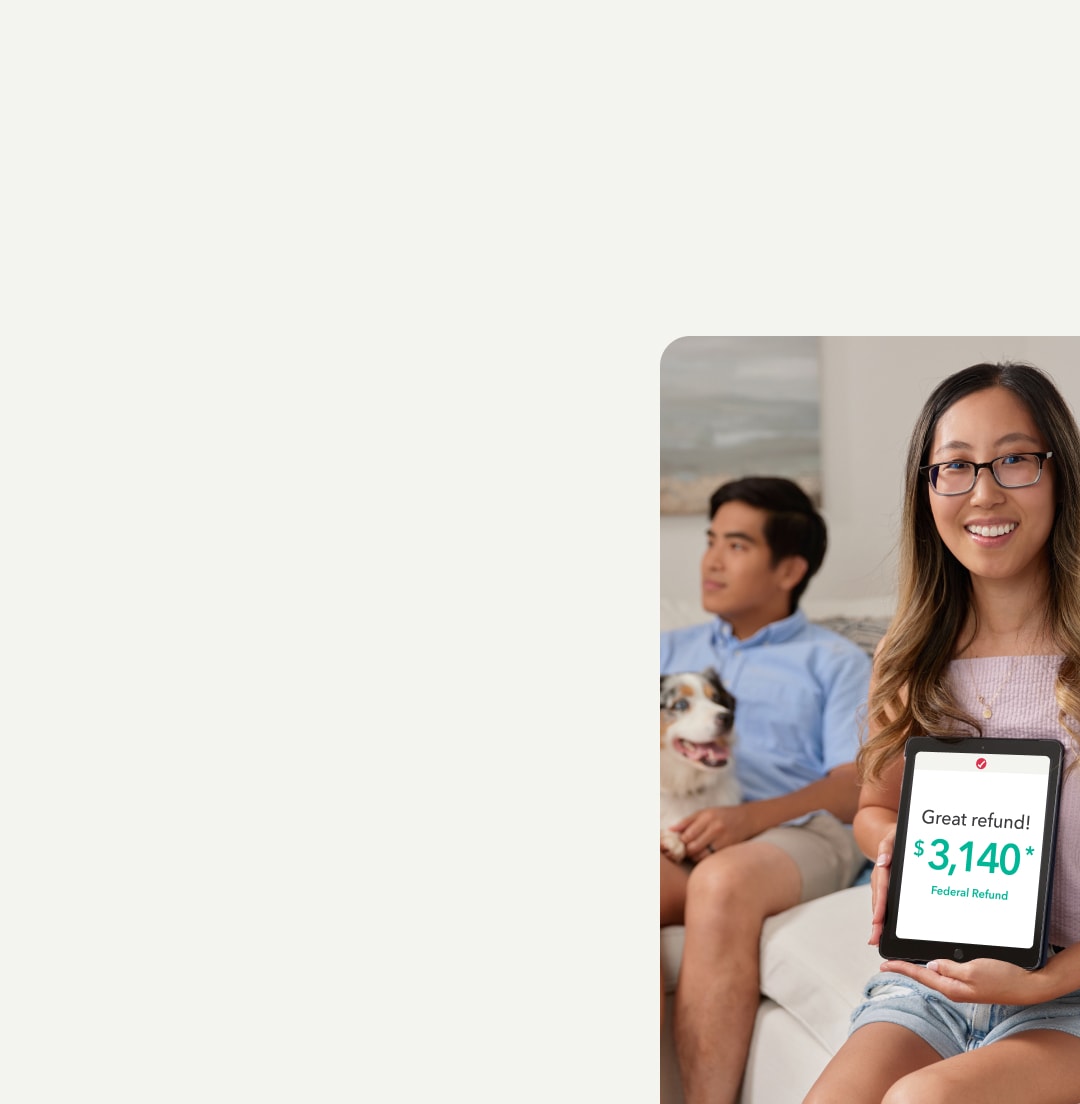

Find out when

to

expect your

refund

If you filed with

TurboTax, sign in to

check

your e-file status

and track

your refund.

Share the love and get $25

Refer a friend to file with TurboTax and get a $25 gift card.* Plus, they can get 20% off when

they file. Offer good through October 15, 2024.

Learn more about e-filing

E-filing is the fastest way to file your taxes and get your refund. But did you know that your e-file status and your refund status aren't the same thing? Once the IRS accepts your return, they still need to approve your refund before they send it to you. Typically it takes 21 days to receive your refund after the IRS accepts your return. In the meantime, you can check your e-file status online with TurboTax.

Frequently asked questions

This simply means your e-filed tax return was sent, but hasn’t been accepted or rejected yet. It should generally get accepted or rejected within 24-48 hours of submitting.

Learn more

It means your return was received and accepted by the IRS. Once the IRS takes a closer look, it should be approved provided everything was correct.

Learn more

Congratulations! This means your e-file has passed inspection and the IRS has your tax return. If you filed with direct deposit, you should receive your return within 3 weeks. If you’re getting a paper check, it can take up to

6-8 weeks.

This means the IRS is sending your return back to you to make a correction. It’s often a simple fix, such as an incorrect birthdate. Once you correct it, you can re-submit your return for approval.

Learn more about what to do if your return is rejected